Tesla’s third-quarter results for 2024 have exceeded market expectations, showcasing strong performance across several key areas, including vehicle sales growth and robust revenue figures.

This quarter’s earnings report reflects not only the company’s sustained growth but also its strategic shifts in product focus and expansion into new business areas.

In this analysis, we’ll cover Tesla’s third-quarter performance, key challenges, ongoing issues, and the anticipated future direction of the company.

1. Q3 2024 Performance Summary : Sales and Revenue Growth

Tesla produced over 470,000 vehicles and delivered more than 460,000 units during Q3, driven largely by strong demand in both established and emerging markets, including China.

The electric vehicle (EV) manufacturer recorded impressive sales growth, which has led to positive quarterly revenues and reinforced its position as a market leader in the EV space.

- China’s Growing Market Share : Tesla has seen high sales in China, a critical region for its growth strategy as the demand for EVs rises among Chinese consumers. This growth is essential to Tesla’s overall financial health and future expansions.

- Robotaxi and Autonomous Tech : Tesla’s ongoing robotaxi project is gaining traction, with advancements in autonomous driving promising long-term growth potential for new revenue streams.

- Cybertruck Anticipation : Tesla has begun scaling up production of the much-anticipated Cybertruck, expected to bolster delivery numbers and revenue for upcoming quarters.

2. Key Challenges : Production and Cost Issues

Despite the upbeat earnings, Tesla still faces significant production and cost-related issues, which could impact its financial performance in the coming quarters.

These challenges highlight the delicate balance Tesla must maintain between scaling production and controlling operational costs.

- Fluctuating Raw Material Costs : The fluctuating costs of lithium and other battery materials have increased production costs. The company may face pressure to adjust pricing to accommodate these rising expenses, which could affect demand.

- Factory Shutdowns and Production Delays : Temporary shutdowns at key facilities, such as those in Texas and Berlin, have introduced supply chain disruptions. Tesla is working to mitigate these issues through new production facilities, but any prolonged delay could hinder growth.

- Labor and Resource Constraints : Labor shortages and sourcing limitations in various markets remain challenges for scaling production efficiently.

3. Revenue Model Evolution : Self-Driving and Energy Ventures

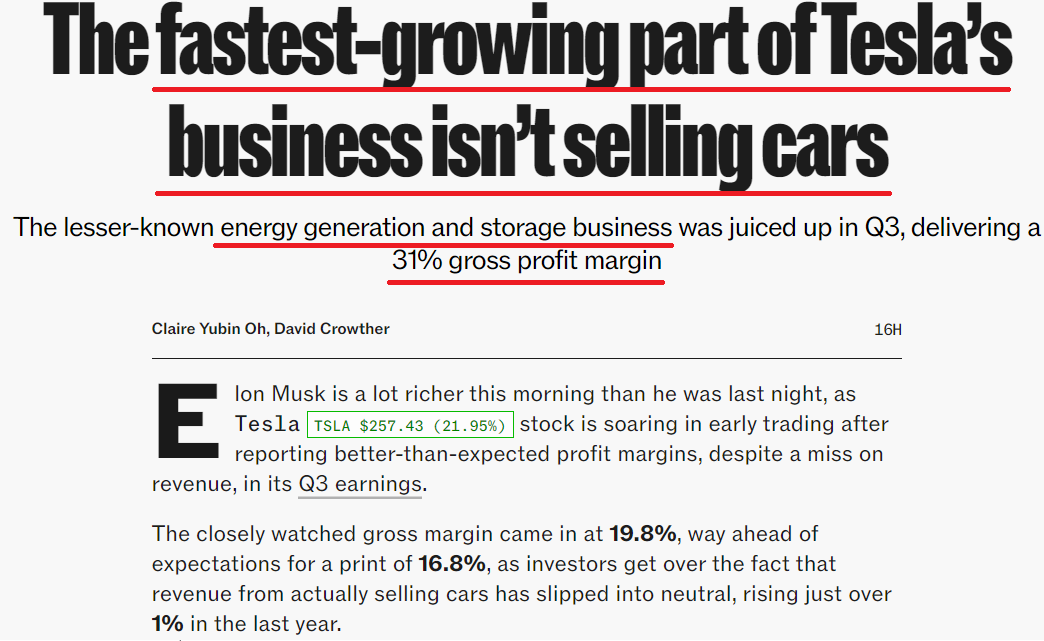

Tesla’s growth strategy increasingly relies on revenue diversification beyond car sales. The company’s expansion into autonomous software and energy storage solutions is expected to contribute to revenue and improve profit margins.

- Autonomous Driving Subscriptions : Tesla’s Full-Self Driving (FSD) software, offered as a subscription service, has shown potential to add significant recurring revenue. This model capitalizes on the increased demand for autonomous vehicles and related software.

- Energy Storage Business : In Q3, Tesla supplied approximately 6.9 GWh of energy storage systems, demonstrating strong growth in this division. The company’s focus on solar and energy storage could become a valuable business segment as demand for sustainable energy solutions rises.

These new revenue channels position Tesla to lessen its reliance on vehicle sales and provide more consistent revenue streams over time.

4. Future Outlook : Growth Potential and Key Risks

Looking forward, Tesla aims to leverage its autonomous technology and energy divisions to drive future revenue growth. The upcoming launches of the robotaxi service and Cybertruck model are expected to impact future earnings significantly, although lingering issues like raw material costs and supply chain uncertainties remain.

- Global Supply Chain Pressures : Ongoing global supply chain issues present Tesla with operational challenges, and navigating these issues will require strategic adjustments and cost management.

- Advanced AI and Self-Driving Technology : As a pioneer in autonomous driving, Tesla continues to invest in its AI capabilities. Maintaining its competitive edge in this space will require innovation and focus on safety and performance.

Conclusion

Tesla’s Q3 earnings surprise underscores its growth potential and strategic shifts toward energy and autonomous solutions.

While Tesla’s strong financial results in Q3 signal a positive trend, challenges such as rising production costs and supply chain disruptions may impact future profitability.

The company's investments in AI, autonomous driving, and energy storage will be pivotal to its long-term success, setting the stage for Tesla’s evolution beyond just vehicle manufacturing.

Wishing you all success and good health!